Non-Dairy Creamer Market Overview

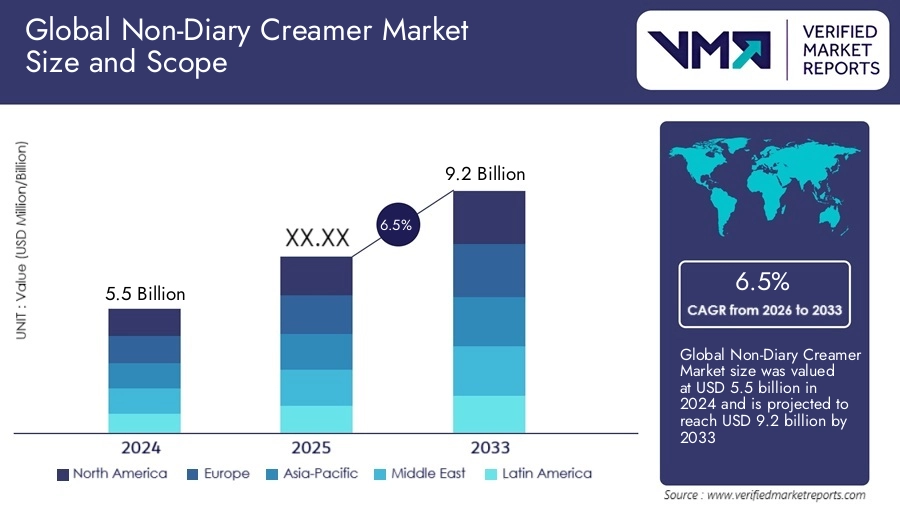

The global non-dairy creamer market has evolved significantly over the past decade, transitioning from a niche segment catering primarily to lactose-intolerant consumers into a mainstream product category that aligns with broader consumer trends toward plant-based, vegan, and clean-label foods. As of 2025, the global non-dairy creamer market is estimated to be valued at approximately USD 7.5 billion, with expectations to reach USD 12–15 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 7–9% during the forecast period.

Several factors contribute to this sustained growth trajectory. Rising lactose intolerance and dairy allergies, increasing adoption of vegan and flexitarian diets, and the perception that plant-based alternatives are healthier are key drivers boosting demand for non-dairy creamers. The modern consumer is increasingly conscious about animal welfare, sustainability, and health, prompting a shift from traditional dairy creamers to plant-based substitutes.

Innovation is a hallmark of this market’s expansion. Manufacturers are investing in research and development to create creamers that closely mimic the taste, texture, and mouthfeel of dairy creamers, using ingredients like almond, soy, oat, coconut, and pea protein. Clean-label trends are also encouraging companies to eliminate artificial flavors, colors, and hydrogenated oils, replacing them with natural sweeteners and healthier fats.

Distribution channels have expanded dramatically in recent years, with non-dairy creamers widely available in supermarkets, hypermarkets, health food stores, cafes, and online platforms. Major coffee chains and foodservice providers now often offer non-dairy creamer options, reflecting consumer demand for more inclusive menu choices.

Another notable trend is the surge of functional non-dairy creamers infused with ingredients such as MCT oil, collagen, adaptogens, and probiotics, catering to the wellness and biohacking communities. Such products appeal to health-conscious consumers who look for added value beyond taste.

Geographically, North America and Europe are mature markets with significant shares, driven by established plant-based food cultures and high disposable incomes. The Asia-Pacific region is projected to witness the fastest growth due to the increasing influence of Western dietary patterns, urbanization, and growing awareness of lactose intolerance.

Despite robust growth prospects, the market faces challenges, including fluctuating raw material prices (e.g., almonds and oats), sustainability concerns around monoculture crops, and the need for continuous product innovation to match evolving consumer palates and nutritional expectations.

Looking forward, the non-dairy creamer market is poised to benefit from technological advancements in food processing, increasing investment by startups and established food conglomerates, and a global push toward sustainable, ethical, and healthier eating habits.

Non-Dairy Creamer Market Segmentation

To better understand the market dynamics, the non-dairy creamer market can be segmented into four broad categories: Source Type, Form, Application, and Distribution Channel. Each segment has distinctive characteristics and consumer drivers.

1. Source Type

Plant-Based Oils Creamer

Plant-based oils, such as coconut oil, palm kernel oil, and vegetable oils, have long dominated the non-dairy creamer market due to their cost-effectiveness and neutral taste. These creamers are often hydrogenated or partially hydrogenated to provide a creamy texture and longer shelf life. While popular in developing markets for their affordability and widespread availability, they have faced criticism due to trans fats and sustainability concerns, particularly with palm oil. Recent shifts towards sustainable sourcing and RSPO-certified palm oil are attempts to address these concerns. Manufacturers are also reformulating to reduce unhealthy fats and align with clean-label expectations. This segment continues to hold significant market share, especially in powdered creamers for mass consumption.

Plant-Based Milk Creamer

Creamers made from almond, soy, oat, coconut, cashew, and pea milk have seen explosive growth in the past five years. These options cater directly to vegan and lactose-intolerant consumers who prefer recognizable ingredients over synthetic alternatives. Oat milk creamers, in particular, have become extremely popular for their neutral taste and sustainable profile. These creamers are typically more expensive than oil-based versions but resonate strongly with premium and health-conscious market segments. They often feature organic certifications, natural sweeteners, and minimal additives, aligning with clean-label and health trends.

2. Form

Powdered Non-Dairy Creamer

Powdered non-dairy creamers represent the traditional form of this product category and still account for a substantial market share, especially in regions like Asia-Pacific and parts of Europe where instant coffee consumption remains high. These products are valued for their long shelf life, ease of storage, and convenient portion control. Large institutional buyers, such as offices, airlines, and the foodservice sector, prefer powdered creamers due to their cost-effectiveness and minimal spoilage risk. Recent innovations include reformulating powdered creamers with plant proteins and natural sweeteners, addressing criticisms about artificial additives and unhealthy fats.