Network Security Monitoring Service Market Overview

In an era where digital transformation drives businesses globally, the importance of robust network security has never been more pronounced. The Network Security Monitoring Service Market has emerged as a critical component within the broader cybersecurity landscape, ensuring that organizations can detect, prevent, and respond to sophisticated cyber threats in real-time.

Market Size and Current Landscape:

As of 2025, the global Network Security Monitoring Service market is estimated to be valued at approximately USD 25 billion, growing steadily due to increasing cyber threats and the rapid expansion of digital infrastructure across industries. With organizations facing rising incidents of ransomware, phishing, insider threats, and advanced persistent threats (APTs), the need for continuous monitoring services has transitioned from optional to essential. Industries such as BFSI, healthcare, government, retail, and manufacturing are particularly driving demand due to the sensitive data they handle.

Projected Growth:

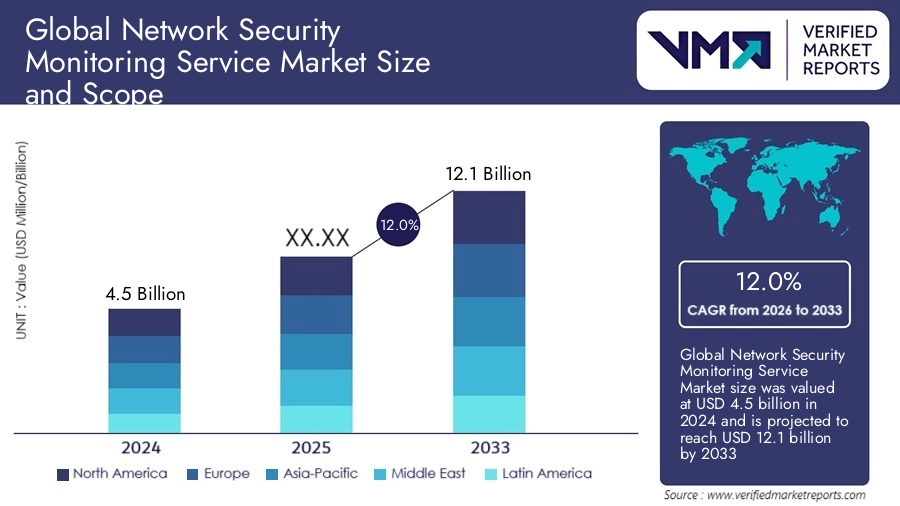

Analysts project the market to grow at a Compound Annual Growth Rate (CAGR) of 12–14% over the next 5–10 years, potentially surpassing USD 60 billion by 2030. The growth trajectory is underpinned by the exponential rise in remote workforces, cloud adoption, IoT proliferation, and the need to comply with increasingly stringent regulatory frameworks like GDPR, HIPAA, and CCPA.

Key Drivers:

Several critical factors are fueling this growth:

-

Increasing Cyber Threat Landscape: Cybercriminals are employing increasingly sophisticated techniques, including AI-driven attacks, deepfake-enabled frauds, and zero-day exploits. Organizations require advanced monitoring tools to detect anomalies and mitigate breaches.

-

Regulatory Compliance: Governments and industry bodies worldwide continue to tighten data privacy and cybersecurity laws. This compels organizations to adopt robust network security monitoring to meet compliance requirements and avoid hefty fines.

-

Remote and Hybrid Work Models: The shift toward remote work since the COVID-19 pandemic has expanded the attack surface for organizations. Monitoring services help secure endpoints and ensure visibility across dispersed networks.

-

Cloud Migration: As companies migrate applications and data to multi-cloud and hybrid environments, the complexity of network infrastructure increases. Security monitoring services provide centralized visibility and incident response capabilities across these distributed architectures.

Technological Advancements and Trends:

The market is witnessing significant innovation. Vendors are integrating Artificial Intelligence (AI) and Machine Learning (ML) to enhance threat detection, reduce false positives, and enable automated response capabilities. Behavioral analytics, threat intelligence feeds, and the rise of Managed Detection and Response (MDR) services are reshaping how organizations approach network security monitoring. Furthermore, the growing adoption of Zero Trust architectures demands continuous monitoring and verification, further driving market demand.

Industry players are also focusing on user-friendly dashboards, integration with Security Information and Event Management (SIEM) systems, and the use of threat hunting tools to proactively identify vulnerabilities. Strategic partnerships, mergers and acquisitions, and investments in talent and research continue to be the norm as service providers aim to expand their offerings and global reach.

Overall, the network security monitoring service market is poised for robust expansion, driven by the dual pressures of an evolving threat landscape and the technological advancements designed to combat it.

Network Security Monitoring Service Market Segmentation

The network security monitoring service market can be segmented in various ways. For this analysis, we’ll break it down into four key segments:

-

By Service Type

-

By Deployment Mode

-

By Organization Size

-

By End-User Industry

Below are detailed descriptions of each segment and their subsegments.